Tucson groups rally to save clean energy credits

Community members in Tucson gathered to oppose proposed federal rollbacks to clean energy tax credits, citing risks to public health, household costs and local jobs.

With clean energy tax credits on the Congressional chopping block, local leaders, health experts and solar advocates gathered last week at Tucson’s Net Zero Solar to sound the alarm on the potential impact to families, public health and Arizona’s clean energy economy.

The event was held in response to Congress’s move to scale back clean energy tax credits, including the Energy Efficient Home Improvement Credit and the Solar Investment Tax Credit, which help Arizonans reduce their energy costs.

“This is just leveling the playing field so that we can make the transition to clean energy and support our residents in the way that people need to be, to be able to survive in these escalating heat and costs,” said Pima County District 3 Supervisor Jennifer Allen.

Cutting the credits would raise electricity costs for families, stall the growth of the clean energy economy and undermine the state’s role as a national leader in solar and energy efficiency, organizers said.

Pima County recently launched its “Beat the Heat” mitigation plan, which includes opening cooling centers, implementing a heat safety strategy for outdoor workers and creating an HVAC training center.

“These are things that we have to do through our community to support one another and to support our economy, the lives and the health and safety of our families,” Allen said.

Extreme heat can cause health issues like dementia, respiratory illness, heart attacks, stroke and premature births, according to Dr. Brian Drummond, an emergency physician and co-founder of Arizona Health Professionals for Climate Action.

Drummond says he treats up to five heat-related patients during each shift.

“These health harms stem from the consumption of fossil fuels,” he said. “The current clean energy tax credits and investments are our treatment for the disease of unhealthy air and extreme heat.”

Home insulation, heat pumps, air conditioning and solar panels are all ways to prevent extreme temperature exposure, which can cause kidney disease and muscle breakdown, Drummond said.

“Living in the desert, our survival is based on the ability to keep ourselves cool where we live,” he said.

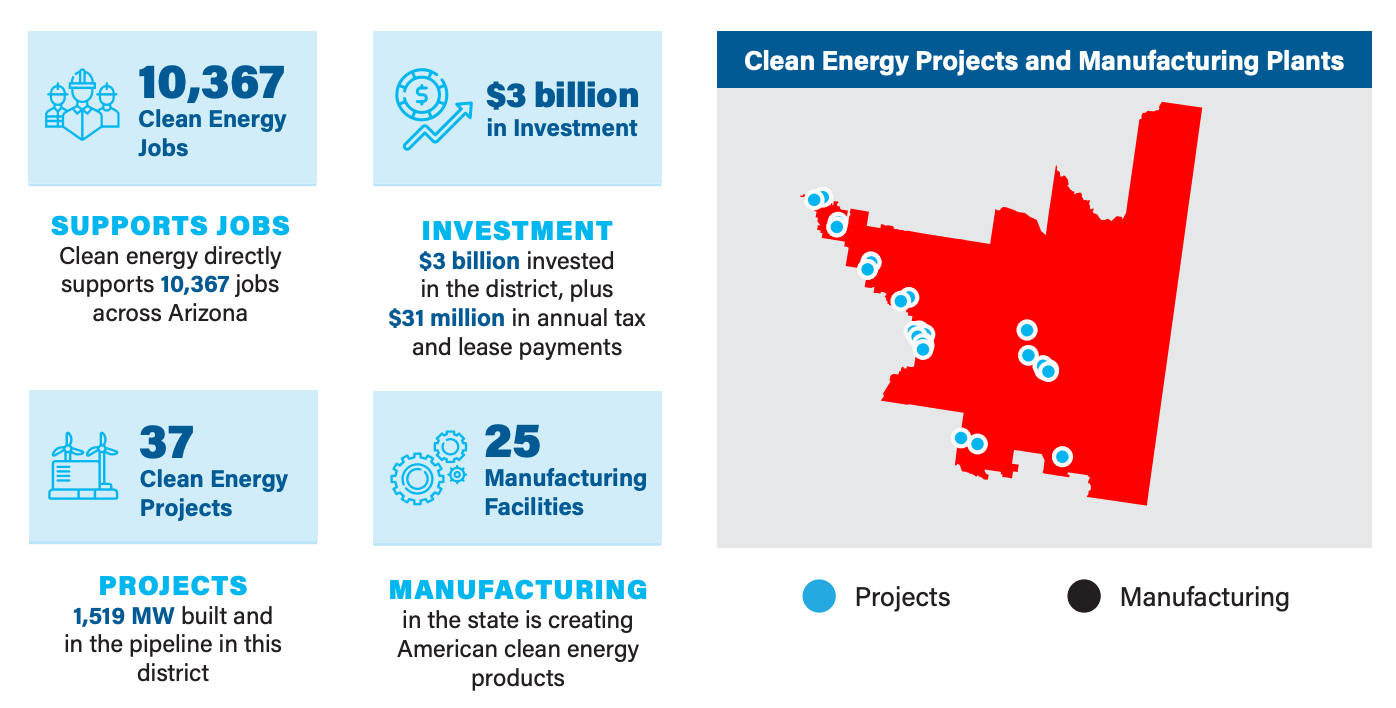

In addition to reducing energy costs, clean energy projects — like installing solar panels and A/C units — create jobs.

“Removal of these credits would critically reduce the benefits from these systems,” said Louis Woofenden, engineering director and owner of Net Zero Solar, a local solar panel and battery installation company that started in 2009 with three employees.

Today, the business has grown to 17 employees.

The manufacturing credits that clean energy initiatives offer to Net Zero Solar allow the group to offer U.S.-made products. Ninety-five percent of its clients use either residential tax credits or business credits for solar battery installation, Woofenden said.

“Clean energy tax credits have been a key driver of our success,” he said. “The residential and business clean energy credits help create demand for solar and provide opportunities for homeowners and businesses.”

Woofenden said the company is exploring ways to retain its employees but warned the proposed bill could slash demand for solar, potentially resulting in significant job losses.

“The reconciliation bill would be simply devastating to our business and to Southern Arizona,” he said.

Maintaining clean energy credits and related jobs helps provide financial stability for households. Nick Arnold, Arizona state director for Climate Cabinet Education, said he personally benefited from these incentives when converting his home to run entirely on electricity.

“These tax credits are extraordinarily important for making sure that we in Southern Arizona and families across this country can afford their energy bills and feel safe and comfortable in their homes,” he said.

Arnold pointed to the cost difference when upgrading from a swamp cooler to a heat pump: the project would have cost $19,000 without tax credits, but with the incentives, he paid just $8,000.

“Those unplanned costs are extraordinarily difficult and they leave you with fear for what’s going to come next,” he said.

On Friday, Senate Republicans introduced a revised bill mandating that solar and wind projects claiming Clean Electricity Production and Investment credits must be completed by the end of 2027; projects after that date would be subject to a tax.

“These are lifelines for our community,” Allen said. “So we’re not asking for anything that is exceptional.”

Arilynn Hyatt is a journalism major at the University of Arizona and Tucson Spotlight intern. Contact her at arilynndhyatt@arizona.edu.

Tucson Spotlight is a community-based newsroom that provides paid opportunities for students and rising journalists in Southern Arizona. Please consider supporting our work with a tax-deductible donation.